No-Code DeFi

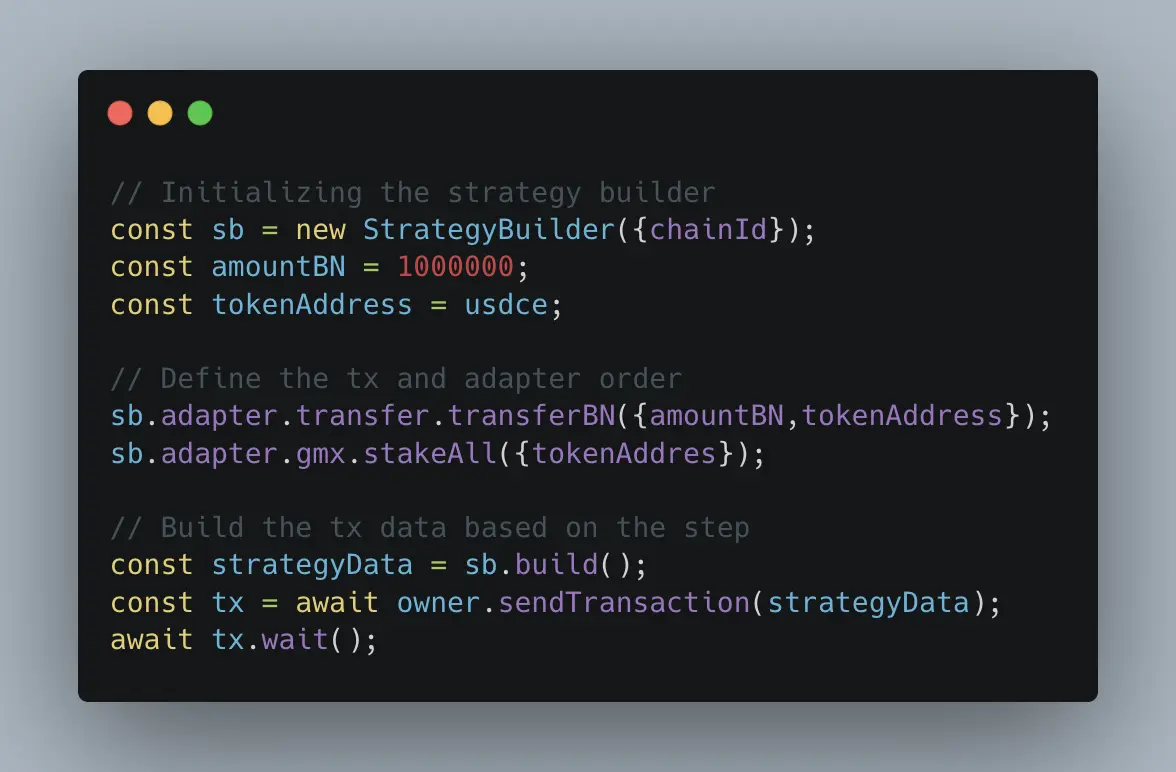

Use Factor Studio's drag-and-drop interface to create complex DeFi strategies.

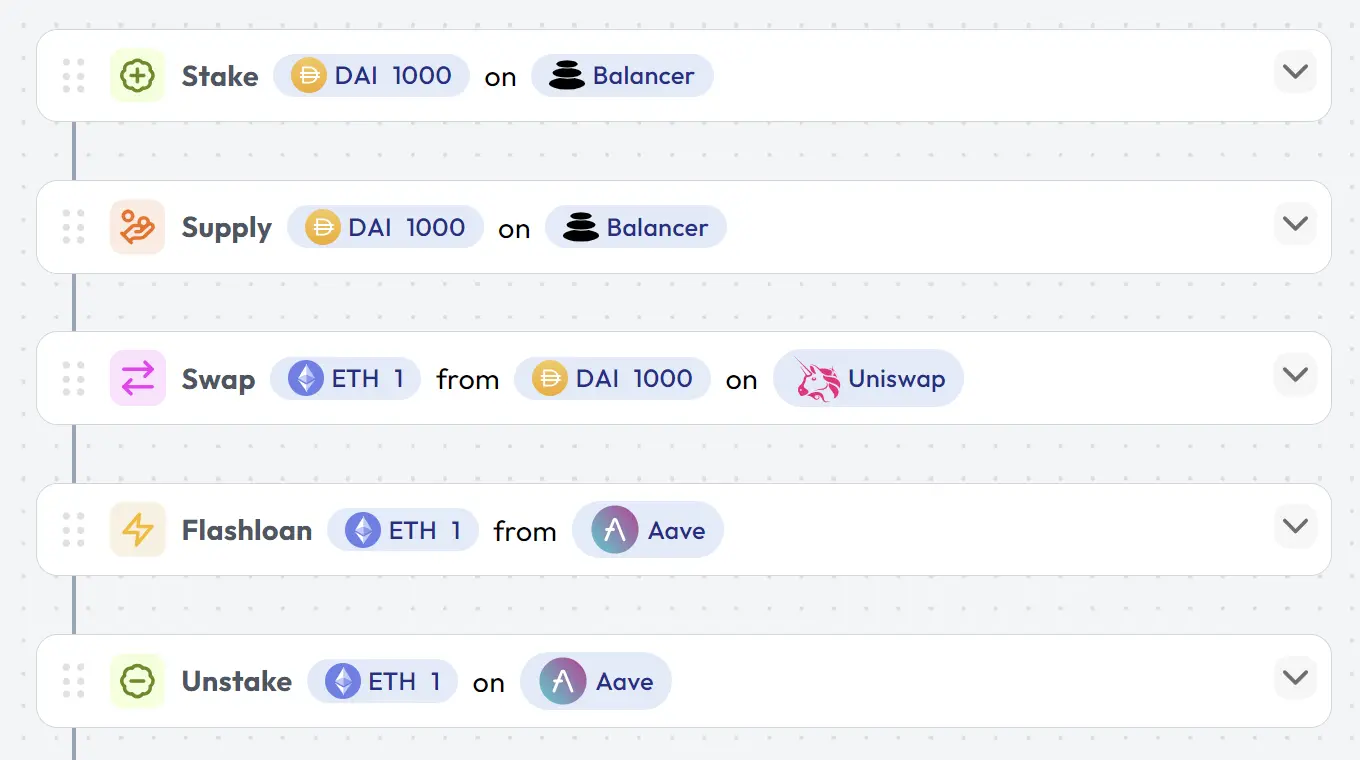

Drag-and-Drop Interface

Simulate and deploy strategies using our intuitive drag-and-drop canvas. No coding knowledge required.

Strategy Templates

Save time with curated strategy templates that chain together commonly used DeFi operations into a single workflow.